Оглавление:

Успешные партнёрства могут приносить миллионы каждый год. Компании в большинстве отраслей проводят партнёрские программы, поэтому вы можете в значительной степени выбирать нишу, которая, по вашему мнению, обещает наибольший доход. Вы всегда можете увеличить свой доход за счёт одних и тех же продуктов.

Нам очень нравится онлайн-курс «Узнайте, как выращивать грибы низкотехнологичным способом» от GroCycle. Интересный и познавательный курс — отличный дополнительный источник дохода для грибоводов, которые его разработали. Покупка и управление ресурсами будут съедать ваши потоки пассивного дохода. Это одна из идей, как создать пассивный доход, когда вы получаете деньги непосредственно за каждый проданный продукт. Далеко не каждый бизнес-проект доходит до запуска. Из-за этого приходится инвестировать сразу в несколько стартапов.

По муниципальным облигациям доход на уровне ОФЗ. Сколько зарабатывают российские коллеги Роулинг, точных сведений нет. Однако на различных ресурсах в интернете часто встречается одна и та же информация. За первую свою книгу писательница Дарья Донцова получила ₽20 тыс. Доход за права на все ее издания оценивается в $2,5 млн и дополнительно $200 тыс. Автор многочисленных детективных книг Александра Маринина получает за одно свое сочинение $100–150 тыс., а гонорар Бориса Акунина за одно произведение составляет около $25–30 тыс.

Ну и смотреть надо кого пускаешь, разговаривать с людьми. И обещает научить вас получать пассивный доход за скромное вознаграждение. По закону ПИФы не могут выплачивать купоны и дивиденды пайщикам, они обязаны реинвестировать всю прибыль. Стратегия «ждать роста и продавать» с ПИФами может не сработать. Если акция ETF продается за пару кликов, то чтобы продать паи ПИФов, придется ехать в офис УК, писать заявления и ждать несколько дней, пока деньги поступят на счет.

Акции компаний в сфере недвижимости

Если же речь об отсутствии начального капитала, то накопить капитал с нуля не удастся. Первоначальные вложения необходимы, чтобы они начали сами зарабатывать деньги. ПИФы обязаны реинвестировать дивиденды и купоны, а не делиться ими с пайщиками. Так что заработать получится только на росте стоимости паев. В то же время акции ETF продаются на бирже за несколько секунд, а для продажи небиржевого пая придется обращаться в офис управляющей компании.

Купить квартиру, дом или коммерческое помещение, чтобы сдавать их в аренду и получать доход. Получайте дивиденды, периодичность и размер которых зависят от прибыли компании и решений руководства. Но акции — рискованные инвестиции, потому что их цена постоянно меняется. Нельзя точно спрогнозировать доходность по этим ценным бумагам. Покупая акции, вы получаете в собственность часть имущества компании и право на дивиденды с прибыли, если эмитент их выплачивает.

Монетизируя контент и создавая цифровые продукты, вы можете создать устойчивый поток пассивного дохода. Кроме того, используя социальные сети и создавая аудиторию вокруг своего сайта или цифрового продукта, вы можете еще больше увеличить доход. Акции и паевые инвестиционные фонды – два наиболее популярных вида инвестиций, и оба они могут быть использованы для создания стабильного потока пассивного дохода. Инвестирование – отличный пример пассивного дохода. Вы инвестируете деньги в акции компании и получаете выплату дивидендов и благодарность за вложения. Вы покупаете недвижимость, сдаете ее в аренду и получаете пассивный доход.

Инвестирование в биткоин (другую криптовалюту)

Но вместо того, чтобы дать кредит владельцу компании, попросите долю акций. В этом случае хозяин фирмы будет управлять работой компании, в то время как вы будете пассивным партнером, тоже принимающим участие в бизнесе. Одним из главных плюсов инвестиций в REIT-трасты является то, что они обычно приносят более высокие дивиденды, чем акции, облигации и банковские вклады.

- Инвестирование сопряжено с рисками и подходит не для всех инвесторов.

- Но давайте взглянем на одни из самых современных способов, с помощью которых вы можете создать источник пассивного дохода благодаря недвижимости, которой вы уже владеете.

- К тому же деньги застрахованы в Агентстве по страхованию вкладов, но не более 1,4 млн ₽.

- Вид пассивного дохода зависит от источника, который приносит владельцу регулярные деньги.

- Довольно сложно определить, когда доход перестает быть пассивным.

Отлично, вы можете превратить это в пассивный доход. Поскольку ваш доход, скорее всего, будет поступать от рекламы или подписок, это менее прямой способ заработать деньги в качестве дополнительного ресурса. Покупка и продажа в социальных сетях требуют постоянной работы, поэтому вы не будете зарабатывать деньги, пока спите. Вы можете разобраться с этим один раз и забыть, пока доверительное управление будет управлять недвижимостью, в которую вы вложили деньги.

Пример успешного блога

как получать пассивный доход от инвестиций создают для финансовой независимости, поэтому для его формирования нужны достаточно консервативные инструменты. Ежедневная работа в офисе, на заводе, стройке не приносит пассивный доход. Это регулярная, текущая деятельность за зарплату.

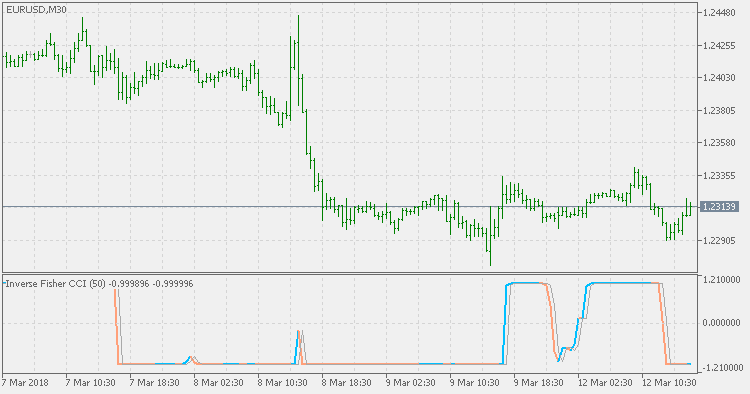

Чтобы начать зарабатывать на ценных бумагах, нужно как минимум освоить азы технического анализа и изучить, как работает фондовый рынок. Для начала работы с акциями нужно открыть брокерский счет. Покупка недвижимости с последующей сдачей ее в аренду считается одним из традиционных способов получения пассивного дохода.

Индексные фонды могут представлять собой совокупность холдингов в различных компаниях, которые диверсифицируют ваш риск по сравнению с отдельными акциями. Вложения в индексные фонды — одна из лучших «покупай и держи» стратегий для новых инвесторов. Индексные фонды — это тип паевых инвестиционных фондов без активного управления и с гораздо более низкими коэффициентами расходов. Статистику успешности портфеля самой компании можно отслеживать в онлайн по данной ссылке.

Первые шаги создания пассивного доходаДифференцируйте вложения. Не стоит инвестировать все свои накопления в один единственный проект. В противном случае вы рискуете потерять свободные деньги, если дело прогорит. Подберите 4-6 источников и инвестируйте в них по % от накопленной суммы. Первый и самый доступный способ получения пассивного дохода — это инвестиции.

Однако не все так просто, как может показаться на первый взгляд. Ведь https://forexww.ru/ требует предварительной подготовки в виде накопления начального капитала, который необходим для создания источника пассивного дохода. С другой стороны современные инструменты делают этот процесс намного проще, чем это было еще десять лет назад. К таким предметам можно отнести газонокосилку, различный инвентарь для строительства и ремонта, крупную кухонную утварь и технику, палатку для кемпинга и т. «Большинство авторов в самиздате получают не авторские гонорары, а роялти.

Однако после окончания разработки можно продать сколько угодно подписок на курс. Если выбрать тему, которая долго останется актуальной, и хорошо его разрекламировать, то подписки будут приносить пассивный доход еще много лет. Хотя принято считать облигации консервативным инструментом, некоторые из них могут давать десятки и даже более процентов годовых. Это происходит, когда эмитент находится на пороге дефолта и курс облигаций резко проседает. Инвестиции в такие облигации подобны рулетке и источником пассивного дохода не являются.

Стоимость акций этой компании с начала января по конец июня 2017 года колебалась от 118 до 155 рублей. Таким образом, доходность составила 5,18-6,81 %. Некоторые российские компании выплатили дивиденды двузначной доходности. К сожалению, нельзя с точностью предугадать, окупятся ли ваши старания. К примеру, вы приобрели квартиру в ипотеку, чтобы затем сдать ее в аренду. Но выйти на планируемую доходность у вас не получилось.

Когда кто-то ищет возможность получать дополнительный заработок, чаще всего ему советуют найти временную подработку. В этом случае вам нужно найти способы получения пассивного дохода – заработка денег при небольшом вложении времени и сил с вашей стороны. Существует бессчетное количество идей пассивного дохода.

Как я создал пассивный доход: 4 способа

Но важно выбирать надёжного застройщика, чтобы не остаться без денег в статусе обманутого дольщика. В конечном счете, лучший актив для инвестирования для получения пассивного дохода будет зависеть от вашего финансового положения, инвестиционных целей и терпимости к риску. Внимательно рассмотрев эти факторы и проведя исследование, вы сможете найти лучшие активы для инвестиций, чтобы получить желаемый пассивный доход. Пассивный доход на банковском депозитеБанковский депозит — стандартный и проверенный временем источник пассивного дохода. Все банки предлагают положить деньги на депозит и получать доход в виде процентов.